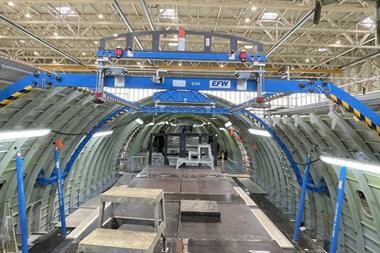

Photo: EFW

Investment firm Stonepeak’s $3.1bn takeover of freighter aircraft leasing giant ATSG has taken another step forward following shareholder approval.

At a special meeting, ATSG’s shareholders yesterday voted to approve the proposed merger with Stonepeak, an alternative investment firm specialising in infrastructure and real assets.

Under the terms of the definitive merger agreement, holders of ATSG’s common shares will receive $22.50 per share in cash upon closing of the merger.

The transaction is expected to close in the first half of 2025, subject to the satisfaction or waiver of customary closing conditions, including receipt of certain regulatory approvals.

Upon completion of the transaction, ATSG will become a privately held company, and its shares will no longer trade or be listed on NASDAQ stock exchange.

ATSG fleet includes Boeing 767, Airbus A321, and soon, Airbus A330 converted freighters.

The firm’s subsidiaries comprise ABX Air, Airborne Global Solutions; Airborne Maintenance and Engineering Services, including its subsidiary, Pemco World Air Services; Air Transport International; Cargo Aircraft Management; LGSTX Services and Omni Air International.

Speaking at the time the deal was first announced, ATSG chief executive Mike Berger said: “This transaction reflects the tremendous value of our fleet of in-demand midsize freighter and passenger aircraft, and the strength of our talented teams across ATSG’s businesses.

“In Stonepeak, we have found a partner that recognises the power of our Lease+Plus strategy to provide comprehensive aircraft leasing and operating solutions to our customers.

“With Stonepeak’s investment and extensive expertise in transportation and logistics and asset leasing, ATSG will be well positioned to further expand its global presence in the air cargo leasing market and enhance its service offerings to customers.”