Latest Xeneta data reveals air cargo demand rose 5% in November while rates fell 5% to $2.73/kg as carriers chase market share

The air cargo market benefited from another month of buoyant demand levels in November but e-commerce - the driver of growth in recent years - is showing signs of slowing.

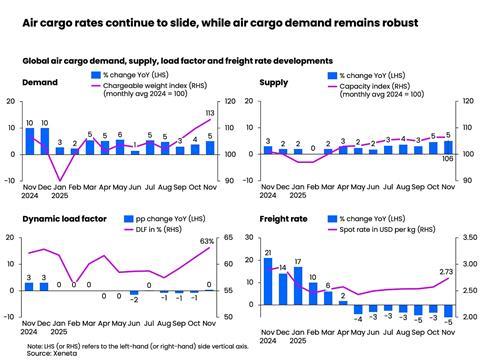

The latest figures from data provider Xeneta show that in November, air cargo volumes increased by 5% year on year, while capacity was also up 5%, the load factor was flat at 63% and freight rates were down 5% to $2.73 per kg.

The demand increase was down to traditional shippers sticking to their annual shipment cycles and a greater understanding of the realities of US trade tariffs, which have been lower, at average of 10-12%, than the 30%, 40%, 50% and 100% that had been threatened.

Xeneta said that rates declined despite the increase in demand because carriers are likely to be "chasing market share at the expense of price discipline”.

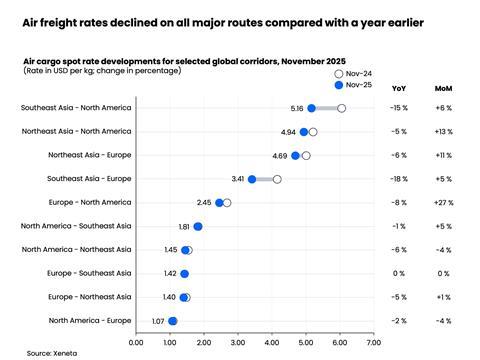

Across all major trade lanes, corridor-level air cargo spot rates in November were lower than a year earlier.

Spot rates on services out of Southeast Asia were hit particularly hard to both Europe and North America.

“This likely reflects a combination of increased carrier capacity deployed to chase nearing 50% demand growth, particularly for inbound North America, and softer volumes linked to e-commerce de minimis restrictions affecting key transit hubs in Northeast Asia,” Xeneta said.

Looking ahead, the data provider was downbeat on the prospects for next year as the increases in US tariffs start to be fed through to consumers in the form of price increases and e-commerce growth weakens.

"After two years in which the growth of air cargo has been so reliant on e-commerce, there is now a question mark over demand for cargo capacity in the coming year,” said Xeneta chief airfreight officer Niall van de Wouw.

"I doubt the global economic concerns will greatly impact the likes of Temu because of the ability of China’s factories to produce stuff at a very low cost for consumers willing to buy them, but the big question for the air cargo industry is whether China’s e-commerce volumes to the world can keep on growing as they have been?

"The indicators suggest it will be very difficult to maintain - and we’re already starting to pick up on flattish growth of e-commerce year on year, which is not something we’ve seen in the last two years.”

Van de Wouw pointed out that after 27 straight months of near 40% year-on-year growth, China’s total cross-border e-commerce sales were flat in October, based on the latest market data from China Customs.

“Even robust expansion from China to Europe - up 47% in October - was offset by declines to the rest of Asia, down 3%, and a dramatic 51% drop in e-commerce shipment volumes to the US in this new post-de-minis environment.”

Next year, the European Union is also planning to tighten up its duty-free exemption for low-value parcels, which is likely to impact demand to the bloc.

The EU is aiming to curb undervaluation of packages and could introduce handling fees for e-commerce packages.

"Such measures are unlikely to materially suppress demand, considering their marginal impact on cost in comparison to alternatives for consumers.

"A greater impact on air cargo demand would come from any changes that slow down the supply chain or introduce hefty extra fees," van de Wouw stated.

Xeneta is expecting low single-digit air cargo demand growth (2-3%) next year and pressure on rates.

“We expect supply to grow more than demand in 2026, and that will have an impact on rates," van de Wouw said. "I also do not think low, single-digit demand growth will satisfy the appetite and ambition of freight forwarders, especially the listed ones that need to grow much faster in the market.

"So, the only way to do that is to grab market share, which would place a further downward pressure on rates in favour of shippers."

“Shippers are asking us what we think is going to happen and, interestingly, we’re also starting to see airlines coming to Xeneta to get a better understanding of shipper rates to validate what forwarders are telling them. Right now, the consensus is the market will do well to achieve demand growth of 2-3% in 2026,” he added.