Embraer is maintaining its outlook for feeder freighter demand, with growing e-commerce demand and regional supply chain operations expected to fuel fleet growth.

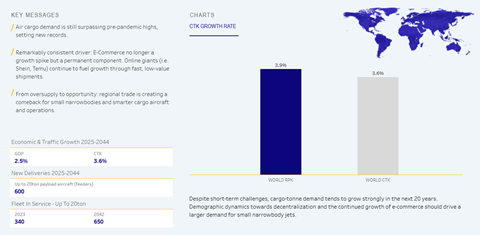

In its annual market report, the regional jet manufacturer said it expects 600 sub-20-ton payload freighter aircraft to be delivered over the coming 20 years - the same number it projected last year.

As a result, the in-service feeder freighter will grow from 340 in 2025 to 650 by 2044.

The aircraft manufacturer based its estimate on a projected cargo tonne km demand growth of 3.6% a year as the cargo market continues to grow faster than GDP, which is expected to increase at a rate of 2.5% per year.

The company explained that it expects e-commerce volumes to support demand for smaller freighters, despite the growing regulatory pressure being faced by online marketplaces.

“Despite predictions that its influence might fade post-pandemic, online-based retailers continue to shape air cargo dynamics,” the report said.

”Platforms like Shein and Temu have built supply chains around speed, employing airfreight to ship low-cost goods quickly and directly to consumers.

”This behaviour is partly driven by rules in many countries that exempt low-cost goods from import taxes or are subject to complex customs procedures. E-Commerce is no longer a growth spike – it’s a permanent component of air cargo demand.”

It pointed out that air cargo demand growth had continued this year despite trade tensions, with the latest IATA figures showing growth of 3.4% over the first four months of the year.

The company admitted that in recent years, the air cargo market had added too much narrowbody capacity as it sought to respond to growing e-commerce volumes, but said that the conversion market had now entered a “cooling phase”.

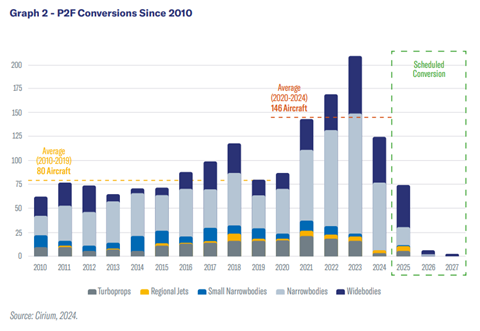

Embraer said that between 2021 and 2023, the market saw a wave of Passenger to-Freighter (P2F) conversions, particularly from Boeing 737-800s and Airbus A321s.

“Over 500 aircraft were converted in only four years [2020-2024], far above the historical average,” it said.

“Many of these were converted speculatively, backed by lessors hoping to capitalise on short-term e-commerce gains and the abundance of parked passenger aircraft during the pandemic.”

Cirium figures show that an average of 146 aircraft per year were converted between 2020 and 2024, compared with an average of 80 aircraft per year between 2010 and 2019.

Only a handful of conversions have taken place so far this year, and data firm Cirium does not expect the pace of conversion seen in recent years to return, according to Embraer.

Embraer added that demand will also be fuelled by ‘friendshoring,’ where companies base manufacturing in politically aligned countries to avoid the risk of supply chain disruption caused by geopolitical tensions.

”To reduce lead times and gain more control, many are establishing regional distribution centres closer to their key consumer markets. Large freighters continue to handle long-haul trunk routes, but the need for fast, reliable movement between regional hubs and local warehouses is growing.

”This is where smaller narrowbody freighters offer a distinct advantage. With the right balance of capacity, frequency, and operating efficiency, they are well-suited to support regional flows, connect secondary markets, and keep pace with the time-sensitive demands of E-Commerce and decentralised supply chains.”