Source: Shutterstock

Air cargo volumes increased strongly in July as growth on the Asia-Europe trade and front-loading ahead of the imposition of more US tariffs supported growth.

The latest monthly figures from airline association IATA show that demand in cargo tonne km (CTK) terms increased by 5.5% in July compared with a year ago.

The performance is a significant improvement on the 0.8% increase registered in June, when US-China tariffs took effect, and the 3.1% increase registered for the year so far.

Meanwhile, capacity in available CTK terms was up 3.9% on last year, and the cargo load factor improved by 0.7 percentage points to 45.1%.

IATA director general Willie Walsh explained that the increase in demand was led by the Asia-Europe trade and front-loading, but added that August would better reflect underlying market conditions.

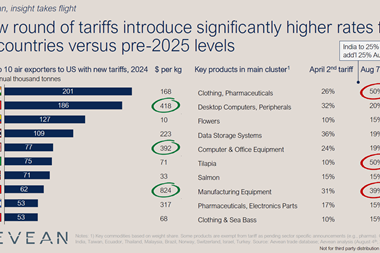

The association added that companies had switched from ocean to air to rush cargo into the US before the implementation of new tariffs.

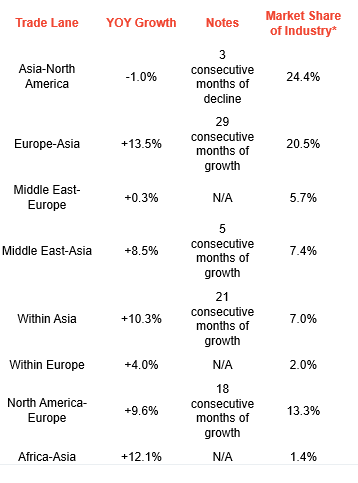

"Air cargo demand grew 5.5% in July, a strong result," said Walsh. "Most major trade lanes reported growth, with one significant exception: Asia–North America, where demand was down 1% year on year.

"A sharp decline in e-commerce, as the US de minimis exemptions on small shipments expired, was likely offset by shippers frontloading goods in advance of rising tariffs for imports to the US.

"August will likely reveal more clearly the impact of shifting US trade policies. While much attention is rightly being focused on developments in markets connected to the US, it is important to keep a broad perspective on the global network

"A fifth of air cargo travels on the Europe–Asia trade lane, which marked 29 months of consecutive expansion with 13.5% year-on-year growth in July.”

Volumes between North America and Europe were also on the rise ahead of the expected implementation of new tariffs in August (a trade deal was later reached), increasing by 9.6%.

IATA added that in July, jet fuel prices were down by 9.1% year on year, which will help ease airlines' operating costs.

Looking at future market indicators, IATA said that global manufacturing contracted in July with the PMI falling to 49.66, the second dip below the 50-mark growth threshold since January.

"New export orders also remained negative at 48.2 for the fourth month, reflecting waning confidence amid US trade policy uncertainty," IATA said.

Regional performance

Looking at regional results, Asia Pacific airlines saw demand grow 11.1% year on year in July, which was the strongest performance of all regions.

North American carriers registered a 0.7% increase - the slowest of the various regions but a big improvement on the 7.9% drop registered in June.

European carriers noted a 4.1% demand increase for July, while Middle Eastern airlines were up 2.6%.

Carriers from Latin America improved by 2.4% and African airlines were up 9.4%.