IATA has reported that the air cargo industry "barely showed growth" in June as market uncertainty due to disruptive global tariff measures continued.

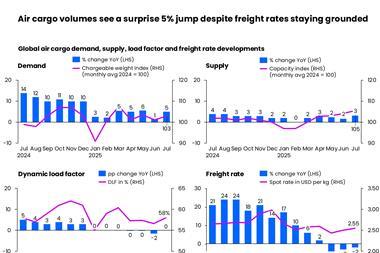

Total demand, measured in cargo tonne-kilometers (CTK), rose by 0.8% compared to June 2024 levels.

"Global air freight volumes barely showed growth in June, adding just 0.8% YoY in CTK, exhibiting weakening world trade derived from the US-enforced tariffs that disrupted established air cargo flows," said IATA.

Reflecting further on volumes, the trade body noted that technology, electronics, fashion, and consumer goods, typically shipped between April and June, were largely frontloaded this year as shippers accelerated deliveries to avoid the impact of incoming tariffs, contributing to higher volumes earlier in the year.

Other goods are currently facing shipment delays, in some cases because production has relocated to countries with more favourable exporting conditions, added IATA.

The results are in contrast to May, when, despite the US implementation of steep tariffs and the ending of the de minimis exemption for shipments from China, air cargo demand increased by 2.2% year on year.

Capacity, measured in available cargo tonne-kilometers (ACTK), increased by 1.7% year on year. However, capacity was reduced by 2.2 percentage points compared to May 2025, "a clear sign of capacity adjustments to accommodate air cargo’s softer demand", noted IATA.

Meanwhile, capacity utilisation, Cargo Load Factor (CLF), decreased 0.4 percentage points compared to June 2024.

Cargo yields continued to soften, with freight rates down 2.5% year on year, though they edged up 0.9% month on month, said IATA.

The trade body warned that the evolving and uncertain tariff situation makes it " hard to plan or streamline the supply chain" and raises "the risk of a deeper cargo slowdown ahead".

“Overall, air cargo demand grew by a modest 0.8% year-on-year in June, but there are very differing stories behind that number for the industry’s major players," said Willie Walsh, IATA’s director general.

"Trade tensions saw North American traffic fall by 8.3% and European growth stagnate at 0.8%. But Asia-Pacific bucked the trend to report a 9.0% expansion. Meanwhile disruptions from military conflict in the Middle East saw the region’s cargo traffic fall by 3.2%."

He added: "The June air cargo data made it very clear that stability and predictability are essential supports for trade. Emerging clarity on US tariffs allows businesses greater confidence in planning.

"But we cannot overlook the fact that the ‘deals’ being struck are resulting in significantly higher tariffs on goods imported into the US than we had just a few months ago.

"The economic damage of these cost barriers to trade remains to be seen. In the meantime, governments should redouble efforts to make trade facilitation simpler, faster, cheaper and more secure with digitalization."

There were some positive economic developments, although these were hindered by tariffs

Global manufacturing rebounded in June, with the PMI rising above the 50 mark to 51.2. The PMI for new export orders improved by 1.2 index points but remained in negative territory (49.3), under pressure from recent US trade policy shifts.

Year-on-year, world industrial production rose 3.2% and global goods trade grew by 3.5%.

The jet fuel price was 12% lower year on year, marking the fourth consecutive annual decline. It was, however, 8.6% up on May prices.

Regionally, Asia Pacific airlines saw a big jump in demand. In contrast, the trade measures implemented by the US government in the past months led to a significant decline in traffic to and from North America, stated IATA.

Asia Pacific airlines saw 9% year on year demand growth for air cargo in June. Capacity increased by 7.8% year on year.

North American carriers saw an 8.3% decrease in growth. Capacity decreased by 5.1%. Middle Eastern carriers also saw a 3.2% decrease, while apacity increased by 1.5%.

European carriers saw 0.8% growth, while capacity increased 2.6%.

Latin American carriers saw a 3.5% increase and capacity decreased by 0.4%.

African airlines saw a 3.9% growth, while capacity increased by 6.2%.

Airfreight volumes in June increased for major trade corridors from/within Europe and Middle East-Asia, said IATA. However, other relevant trade routes from/within Asia and from North America have decreased significantly in the most recent month.