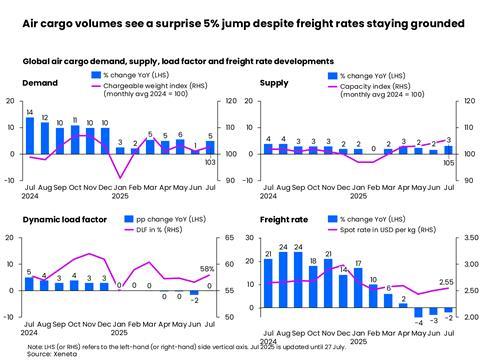

Market analysis for July showed global air cargo volumes climbed 5% year on year as frontloading continued and more shippers opted to send their goods by air to avoid the impact of tariffs.

Xeneta's analysis for July was a surprise turnaround from IATA's report of weakened trade due to tariffs in June, which saw just 0.8% year on year growth. However, Xeneta stressed the growth is certainly to do with the efforts of companies to avoid additional tariff-related costs rather than a recovery in trade.

"This unexpected boost, bucking seasonal patterns, appears driven in part by tariff-related frontloading, mode shift, and persistent uncertainty, prompting businesses to expedite shipments," said Xeneta.

Chief airfreight officer, Niall van de Wouw said: “As we said earlier in the year, air cargo is piggybacking on the chaos being caused by tariffs. While the growth in July will come as a pleasant surprise to many, this growth is not a consequence of increased trade. It is a sign of the creative ways companies are trying to circumvent the higher costs of tariffs."

He added that shippers are prepared to pay more for air over sea now, rather than the alternative of paying higher tariffs on goods in the future.

“What we are seeing currently is a mode shift, and that is helping the airfreight market in the short term. If you’re trying to circumvent tariffs, you’re going to want to do it fast, and a plane is faster than a ship. Having goods in an ocean container for 30 days will feel like a very long time for a lot of businesses right now.

“Businesses are getting creative to try to avoid or lessen the impact of tariffs. It’s a game of ‘cat a mouse’ between the US administration and companies,” he added.

With cargo capacity in July increasing by a lower level of 3% year on year, the 5% rise in volume helped lift the dynamic load factor, which has now returned to levels comparable with a year earlier (58%) and recovered the 2 percentage point decline recorded just a month ago.

Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

Despite the unexpected uplift in volumes, Xeneta said that market sentiment remains subdued as US tariff discussions continue, with a new deadline now set for 7 August for a broad range of trading partners.

"The lack of clarity continues to cast a shadow over global trade flows, particularly in the airfreight sector."

In addition to tariffs, the industry has to prepare for the fallout from the US' decision to end the de minimis exemption for all countries by the end of August. The broader rollback will primarily affect Canada, the UK, and Mexico.

Following the removal of the exemption for shipments from mainland China and Hong Kong in May, there was a 50% drop in China’s low-value and e-commerce exports to the US in June, according to China customs statistics.

Rates down

Rates didn't fare as well as volumes last month. Global air cargo spot rates declined for a third straight month in July, falling 2% year on year to $2.55 per kg.

Yet the rate of decline has eased, thanks to the resurfacing demand-supply imbalance, said Xeneta.

Notably, the gap between seasonal rates (valid for over one month) and spot rates (valid for up to one month) has widened - from 5 cents below spot rate in late May to more than 20 cents below by the end of July, indicating subdued mid-term confidence.

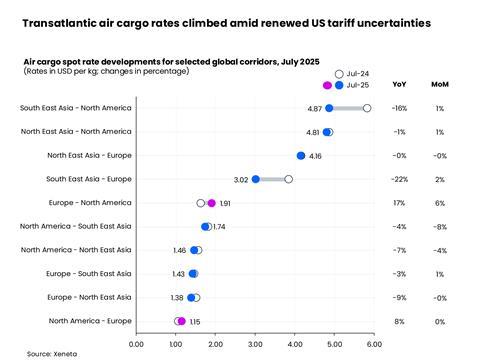

Airfreight rates along the transpacific corridor weakened markedly in July. Spot rates from Southeast Asia to North America fell by 16% year on year to $4.87 per kg, as earlier capacity constraints eased.

In contrast, rates from Northeast Asia to North America remained relatively flat at $4.81 per kg, buoyed by robust demand out of Taiwan. There, spot rates climbed 9% year on year to $6.85 per kg, fuelled by surging appetite for AI and semiconductors.

Mainland China also saw rates to the US fall. Spot rates to the US declined by 11% to $4.26 per kg, weighed down by both the de minimis ban, heightened tariffs, and market uncertainty, Xeneta summarised.

On Asia-Europe routes, spot rates from Northeast Asia to Europe held steady at $4.16 per kg. But a shift of freighter capacity from the Pacific to Europe helped absorb a near 90% surge in cross-border e-commerce volumes from China to Europe as per June data from China Customs. That reallocation has so far kept rates aloft, said Xeneta.

By contrast, Southeast Asia to Europe fared less well, with spot rates tumbling 22% year on year to $3.02 per kg.

The transatlantic market stands out as the only major corridor to post considerable rate increases in both directions. Spot prices rose to $1.91 per kg westbound and $1.15 per kg eastbound. A combination of frontloading activity and reduced bellyhold capacity from passenger flights nudged rates higher.

Uncertainty benefits airfreight

The continuing lack of clarity and uncertainty around tariffs "is “one of the few things that might protect air cargo demand in the coming months because hardly anything has been finalised in relation to tariffs", said van de Wouw.

However, "the piggybacking will stop", he warned. “Economists agree this climate is not good for anyone and, sooner or later, something must give, and demand will fall.

"How long it will be before reality kicks in is hard to assess because this is one massive political dance. In the meantime, air cargo stands to benefit."