E-commerce sustained air cargo volumes despite tariff uncertainty and geopolitical headwinds, while yields declined as supply-demand normalised

E-commerce drove global air cargo demand growth in 2025, although the rise was not as high as the previous year and growth is expected to moderate again this year.

Full-year demand for 2025, measured in cargo tonne-kilometers (CTK), increased 3.4% compared to 2024. Capacity, measured in available cargo tonne-kilometers (ACTK), increased by 3.7% year on year.

IATA noted that e-commerce served to lift volumes even in the face of geopolitical and economic challenges, while the industry quickly adjusted to supply chain changes.

The trade body said total demand growth reflected "a move towards growth normalisation". It added: "Rather than reflecting a broad-based trade surge, growth remained selective, anchored in e-commerce, supply-chain reconfiguration, and a continued preference for time-critical transport.

"Furthermore, air cargo enabled businesses to adjust to the quickly changing trade policy landscape throughout the year, including by frontloading deliveries."

Additionally, IATA noted that full-year yields fell 1.5% year on year. IATA noted that a more normal supply-demand balance is in place now, compared to the exceptionally strong yields that characterised the pandemic years.

“Air cargo delivered a strong performance in 2025, with demand up 3.4% year-on-year," said Willie Walsh, IATA’s director general.

"Global e-commerce strength drove volumes, even as trading relationships with the US faced rising tariffs, the removal of de minimis tariff exemptions, and continuing policy uncertainty.

"Air cargo rose to the occasion. It adapted quickly to support global businesses and supply chains as they front-loaded product deliveries ahead of tariff impositions and adjusted to rising demand within Asia and between Asia and Europe as US-Asia trade stagnated."

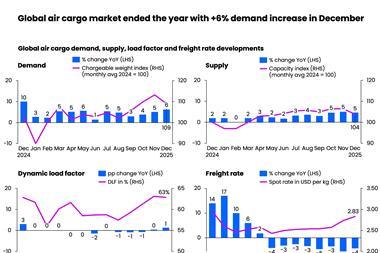

For December, global demand was 4.3% above December 2024 levels. "Growth was concentrated in key regions and trade lanes, underscoring resilient and targeted global freight flows rather than a broad-based trade upswing," said IATA.

Meanwhile, capacity was 4.5% above December 2024 levels. IATA explained: "Growth reflected measured fleet deployments, with capacity absorbed unevenly across regions and trade lanes."

Cargo yields eased for the eighth month, down 2.6% year on year, while month-on-month rates were broadly stable, contracting 0.4%.

Economic conditions reflected the volatile operating climate somewhat. Jet fuel prices averaged 9.1% lower in 2025 than in 2024. However, higher crack spreads meant refiners captured more margin, offsetting part of the benefit for airlines. Prices fell 3.1% in December.

From January to November, global trade in goods grew 4.4%, compared to 2.4% for the same period in 2024.

Global manufacturing sentiment strengthened in December to reach 50.9. New export orders fell slightly to 49.1, but remained below the 50-point expansion threshold, reflecting ongoing caution amid tariff uncertainty.

Overall demand this year will be shaped by trade volatility, noted Walsh. "Growth in 2026 is expected to moderate slightly to 2.4%, in line with historical trends. We can expect that demand will continue to be shaped by trade and geopolitical developments.

"Whatever trading patterns emerge, we can be confident that reliance on air cargo to keep global supply chains running will remain, with carriers responding to the challenge by deploying capacity and designing their networks for optimum flexibility."

Regional Performance

Asia-Pacific airlines saw 8.4% year-on-year demand growth for air cargo in 2025, the strongest among the regions. Capacity increased by 7.4% year on year. December year on year demand increased 9.4% and capacity increased 8.3%.

North American carriers saw a 1.3% decline for 2025, the only regional decline and the weakest performance globally. Capacity decreased by 1.1%. December demand decreased 2.2% and capacity decreased 2.6%.

African airlines saw 6% growth in 2025. Capacity increased by 7.8%. December demand increased by 10.1%, the highest of all regions, and capacity increased 9.8%.

European carriers saw 2.9% growth. Capacity increased by 3.1%. December demand increased 4.9% and capacity increased 3.9%.

Latin American and Caribbean carriers saw 2.3% growth. Capacity increased by 4.5%. December demand decreased by 4.1%, the lowest performance of all regions. Capacity increased 4.5%.

Middle Eastern carriers saw 0.3% growth in 2025. Capacity increased by 4.5%. December demand increased 4.2% and capacity increased 10.6%.

"2025 trade lane data shows a clear shift in global air cargo flows from Asia–North America to Asia–Europe driven by tariff pressures and the removal of the US de minimis exemption. The Within Asia, and the Middle East–Asia corridor also recorded strong growth," said IATA.

Figures from data provider Xeneta show that air cargo demand increased by 6% year on year in December and was up by 4% for the year overall.