The latest monthly figures produced by analysts and consultants show that air cargo had another escape in terms of demand levels in May, but rates started to come under pressure as weak market sentiment continues to weigh on the outlook.

The latest figures from Xeneta show that airfreight demand increased by 6% year on year in May, while capacity was down 2% and the dynamic load factor was flat at 57% despite trade volatility and economic uncertainty.

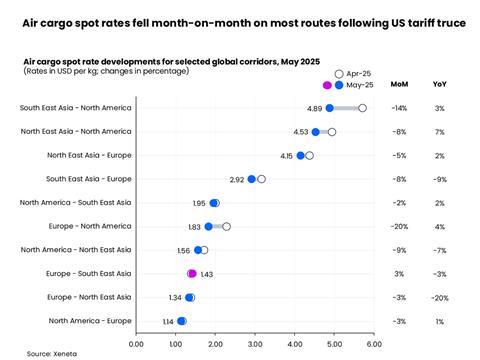

On the other hand, the average global airfreight rate for May fell 4% compared with last year to $2.44 per kg - the first decline since April last year.

The increase in demand came as the US and China cancelled their tariff war for 90 days on 14 May, which saw Washington reduce its duties from 145% to 30%.

Tariffs on e-commerce goods have also been lowered to 54% or a flat fee of $100 for parcel shipments or 30% for those using commercial airlines.

Xeneta chief airfreight officer Niall van de Wouw said that much of the increase in demand for May was fuelled by “emergency” shipments following the trade detente rather than because of the strength of underlying demand.

The decline in rates, meanwhile, is likely the result of market sentiment and lower fuel prices, which are tracking around 20% below where they were last year.

“Market fundamentals are holding up, but the drop in rates is likely a reflection of declining sentiment and concerns, particularly among airlines, over what will happen once more stability returns to international trade and there is less of a push for the security of airfreight,” said van de Wouw.

"Whatever worse trade conditions take away from overall trade, this uncertainty gives a bit back to airfreight.”

"This climate is reducing trade and airfreight is getting a temporary piggyback on this uncertainty through an increase in ‘emergency shipments’ but that will not continue."

The speed of airfreight compared with ocean is also benefiting the industry as shippers look to get goods into their warehouse before trade policy changes again, something that is harder to do when using container shipping, given the lead times.

He added: “At the moment, the climate might be positive on certain lanes to airfreight demand, but there will be a time when there’s an agreement on tariffs – and I don’t expect the end result to promote trade and will, therefore, hamper airfreight."

As well as the market outlook being tough, airlines will also be looking to hold onto volumes and settle rate negotiations more quickly than recently.

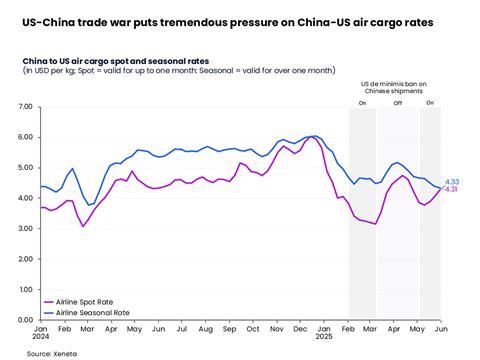

Looking more closely at the rate figures provided by Xeneta, there was a surge in spot market pricing over the month from China to the US.

The data provider said that by the week ending 1 June, spot rates from China to the US had increased 14% to $4.31 per kg compared with their low point in the week ending 11 May before the tariffs were reduced.

"Despite the recent uptick, however, China to US seasonal rates continue to trend downwards from their early April peak (prior to Liberation Day in the US), signalling ongoing caution in the mid-term market outlook," Xeneta said.

Another demand surge to come?

Xeneta also suggested that air cargo could benefit from another demand surge when the tariff reduction ends on 9 July for most countries and 13 August for China.

Prices have already been increasing in ocean shipping, which could be an indicator for air cargo given the longer lead times involved.

Van de Wouw concluded: "The sentiment we saw in May may be preluding market fundamentals, leading to less demand, falling rates, and lower load factors.

"But one thing is clear; the airfreight market will get through this. We just don’t know how long it will take. Industry professionals are going to need a lot of energy to work in this environment, but it’s also a time to be respectful of all stakeholders.

"In the current climate, it’s important to think longer-term and to protect relationships because the challenges being faced today will pass."