Source: Shane Hoggatt/Shutterstock

Air cargo capacity on the transpacific has tumbled over the last week as airlines contend with declining volumes following the US decision to end the de minimis exemption for packages from China.

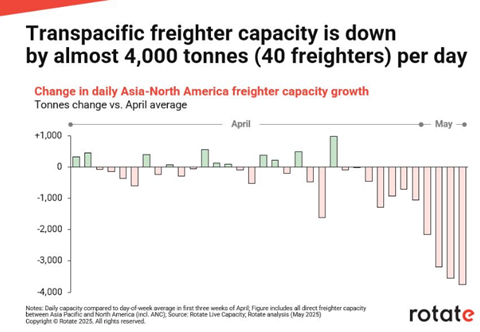

Writing on LinkedIn, Rotate vice president and head of consulting Tim van Leeuwen said on Tuesday that transpacific freighter capacity was down by 40 freighter flights per day compared wth the April average, which represents a decline of 4,000 tonnes per day or 40% of previously operated capacity.

Some of the capacity seems to have been moved to North America-South America trade to capitalise on the Mother’s Day flower season, he said. Rotate figures comparing widebody freighter capacity in the past week against the average over the previous month, showing that capacity on that trade is up 20% southbound and 23% northbound.

However, he adds that much of the widebody freighter capacity has just been parked up.

"The situation is unlikely to change quickly for carriers, who will be assessing options for redeployment at the moment. [The] general strategy seems to be to not fly, with global freighter capacity down ~10% on last week,” van Leeuwen said on Monday.

He added that close to 50 large (B777/B747) freighters - or 10% of the global large freighter fleet - had not operated any flight globally for at least three days.

"Rotate's strategy consulting team has looked at the inverse of our Live Capacity data to see which aircraft are not flying, and found that (as of the time of posting) 46 aircraft registered their last landing between April 30 and May 3, thus not operating for at least 60 hours. Unsurprisingly, these aircraft are mostly operated by carriers active on the transpacific market.

"This confirms our observation that airlines' strategy for dealing with lower Transpacific demand seems to have been 'fly less', rather than 'fly elsewhere'."

He added that airlines might be sending freighters for maintenance whilst demand is low, but the "real question is what do these aircraft do next?"

On the demand front, figures from WorldACD show that demand was trending downwards ahead of the end of the de minimis exemption.

Its latest figures, released today, show that in week 18 (ending May 4), chargeable weight from China and Hong Kong to the US was down 14%, while, for comparison, from China and Hong Kong, there was a 3% fall.

“There seems to be a big difference in the relative performances of those markets,” WorldACD said in its weekly market summary. “This suggests that the changes in the China-US (de minimis) rules are already having a significant effect.”

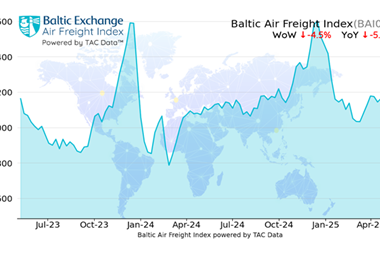

Rates from China to the US have also been falling. In week 18, average spot rates fell for the fourth consecutive week, dropping a further 9% to 3.85 per kg.

But the analyst said it will not be until next week that the full impact of the ending of the US de minimis exemption for packages from China will be apparent in its figures.

"The ending on 2 May of ‘de minimis’ import reporting and fee exemptions for goods from China and Hong Kong to the US looks set to have a very big impact on air cargo markets, with several reports indicating that dozens of weekly transpacific freighter services have been cancelled or suspended or shifted to other markets such as the transatlantic.

"But the full effects are likely to become clearer in the figures for week 19, when a full week of post-de minimis figures are available.”