CMA CGM's Indamex service marks a notable step towards Red Sea return, though security risks and overcapacity concerns persist across the container market

The first major container shipping line has announced plans to return to scheduled operations through the Suez Canal in a notable step towards a large-scale return of container ships to the Red Sea region.

Last week, CMA CGM announced that from 15 January, its Indamex service between India/Pakistan and the US east coast would transit the Suez Canal in both directions as part of a scheduled operation.

Supply chain analyst Xeneta said that carriers, particularly CMA CGM, have been testing the water recently by transiting Suez Canal on a ”select few voyages” but these have been on a case-by-case basis.

Since 2024, the air cargo industry has benefited from container shipping lines needing to sail around the southern tip of Africa on their way to Europe, rather than through the Suez Canal, which has extended transit times from Asia by weeks.

Industry commentators have warned that when shipping lines return to the Suez Canal route, volumes are likely to shift back to ocean shipping, hitting growth expectations.

Peter Sand, chief analyst at Xeneta, said: “We are still some way from a large-scale return of container shipping to the Red Sea, but CMA CGM’s announcement of a full east-west loop via Suez is certainly a notable step in the right direction.

"Other major carriers, including Hapag-Lloyd and Maersk, have not announced a firm timeline for a large-scale Red Sea return, while ZIM has stated it is waiting for insurance approval.”

The number of container ships transiting Suez Canal in November 2025 was 120, down from 583 in October 2023, shortly before the escalation of attacks on merchant ships in the region by Houthi Militia.

"Carriers will be carrying out risk assessments and the security situation remains fragile,” said Sand. ”The assessment will look at the Houthi’s ability, opportunity and intent to attack ships.

"We know they have the ability, but carriers will want assurance over their intent, especially because the opportunity will increase as more ships begin sailing through the region.”

Any large-scale return has other implications, too. The shorter transit times mean fewer vessels are needed to operate a loop and could result in overcapacity.

The Indamex service, for instance, will reduce its transit time by two weeks by switching to the Suez Canal, which will make two vessels redundant.

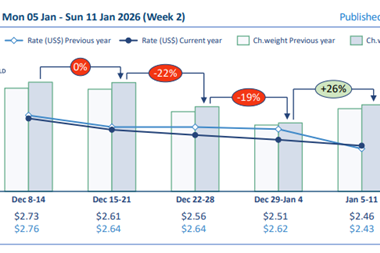

“There is already overcapacity of supply in the ocean container shipping market and spot rates are falling even without a large-scale return to the Red Sea," said Sand.

“If we see other carriers follow CMA CGM, then capacity will flood the market and we could see freight rates fall hard. This could push carriers further towards loss-making territory, but they will be fully aware of this outlook and ready to respond.”

Speaking at the TIACA Air Cargo Forum event in Abu Dhabi, Ryan Keyrouse, chief executive of consultant Rotate, warned that an improvement in ocean shipping reliability would likely result in modal shift from air.