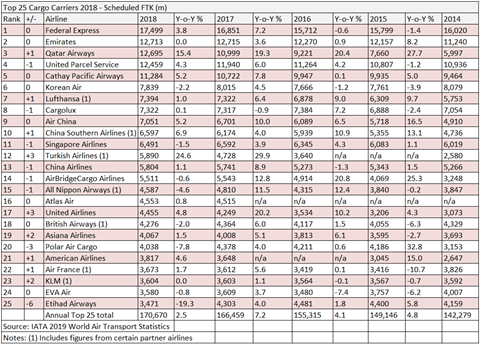

FedEx retained its position as the world’s busiest cargo airline in 2018, but the passenger and freighter fleet of Qatar Airways continued to close in on number two Emirates (see chart at end of article).

The latest IATA World Air Transport Statistics report shows that express operator FedEx was again the busiest cargo airline in the world with volumes improving by 3.8% year on year to 17.5bn freight tonne kms (FTK) in 2018.

It is likely to retain the top spot for the foreseeable future as it is in the process of upgrading its fleet.

Last year, the company ordered an additional 12 Boeing 777 Freighters and 12 B767Fs.

As of May 31, its fleet stood at 681 aircraft compared with 670 aircraft a year earlier and 657 in 2017.

Bert Nappier, president of FedEx Express Europe, said: "Our ability to move significant volumes quickly and reliably through our global networks makes us a key facilitator of growth for our customers. While these are impressive figures, they are only achieved through the trust of our loyal customers and our dedicated team members delivering outstanding service around the world each day."

Not including express airlines, Emirates came top of the pile despite demand being flat at just over 12.7bn FTK.

In light of the weakening market conditions, the airline has shown its resolve in fleet discipline after downsizing its dry lease freighters from 15 to 11 aircraft over the past two years.

Nabil Sultan, divisional senior vice president at Emirates SkyCargo, recently told Air Cargo News that “every year has its own challenges” with 2018 blighted by higher fuel prices and the impact of the dollar currency exchange in Europe, China and the Indian sub-continent customer base.

The airline’s freighter fleet currently comprises 11 Boeing 777F aircraft, all leased from Dubai Aerospace Enterprise. It also operates 255 passenger aircraft.

According to its own figures – IATA statistics do not include charter operations – the carrier recorded a 1.4% increase in cargo tonnage last year in the bellyhold of its passenger aircraft as well as volumes carried on its freighters.

That increase, said Sultan, has a lot to do with the carrier’s diversification of its product portfolio over the past three to four years.

One immediate result of which was a 14% surge in pharma goods to 75,000 tonnes, a welcome increase at a time of economic uncertainty.

Sultan said that the carrier will remain flexible: “So far, utilisation has been good and we continue to operate decent load factors.

“However, looking at the economy, over the coming year we might have to re-evaluate what will happen to production and if you have to reduce some of the capacity, then we will definitely do that.

“It is important to know that we are fully utilising the freighters, and as the operator of a large freighter network, we always monitoring the trade situation very closely.”

Qatar Airways, however, continued to close in on Emirates as it expanded its fleet and network and recorded the second highest growth rate of airlines on the chart as it saw cargo traffic increase by 15.4% to just under 12.7bn FTK.

The increase in cargo traffic helped Qatar leapfrog UPS into third place on the list.

The airline has the stated ambition of becoming the world’s largest cargo carrier and there has been no let-up in its pursuit of this ambition in 2019, despite the market slowdown.

Just last week the airline formalised an order of five Boeing 777 freighters, which will increase the airline’s B777F capacity by 20%.

The company has already added a single B777F to its fleet this year, while five more are due to arrive in the coming six months. In the other direction, it has returned three A330Fs that it had on lease.

Last year the carrier added two brand new B777Fs.

“This order will enable Qatar Airways Cargo to grow to become the number one global cargo carrier this year in both fleet and network,” Qatar Airways Group chief executive Akbar Al Baker said at the signing ceremony.

Qatar Airways chief officer cargo, Guillaume Halleux added: “We are very excited about these announcements. The addition of the five B777Fs will be beneficial for our customers’ business as we can offer them greater capacity and increased frequencies on high demand routes.”

Qatar Airways currently operates 23 freighters, including 16 B777Fs, five A330Fs and two B747-8Fs. Its passenger fleet stands at 200 aircraft.

In terms of freighter network, Macau was added last year, while 2019 has seen the introduction of Almaty and Guadalajara. It will also add three new routes; Hanoi to Dallas, Chicago to Singapore and Singapore – Los Angeles – Mexico City.

In the opposite direction, Etihad Cargo dropped six places on the list to number 25 as cargo traffic declined by 19.3% year on year to 3.5bn FTK.

The company told Air Cargo News that it has been busy re-adjusting its network strategy over recent years.

Managing director cargo and logistics Abdulla Mohamed Shadid explained that in the light of changing market conditions, it was evident that the airline had concentrated too much on creating a global footprint and not enough on developing other key areas of the business such as the technology, which customers are demanding to improve business processes.

Etihad exited its A330F fleet last year and now operates B777Fs which are flying mainly to core markets like Europe and Asia (eg India, Vietnam and China), complementing the bellyhold capacity that feeds more than 90 destinations including North America, Africa and Australia.

With reduced capacity effectively helping Etihad eliminate “bad revenue”, the smaller footprint has allowed Etihad to refocus and fine tune the network, and this allowed it to open up Singapore as a new route and increase Shanghai frequencies.

According to its website, the airline operates six B777Fs as well as a passenger fleet of 102 aircraft.

This is an abridged version of our full report which will appear in the September issue of Air Cargo News, including extra tonnage data.