Image source: Shutterstock

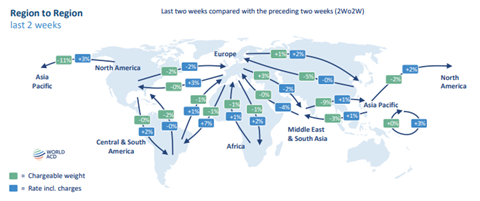

Volumes between Asia Pacific and the US showed signs of life in recent weeks, while from Europe, figures have weakened, potentially a sign of volumes rebalancing as a result of the US finalising more tariff arrangements.

Figures from WorldACD show that chargeable weight between China and the US increased by 1% in the week ending August 10 (week 32), following flat figures in week 31 and a 5% increase in week 30.

In addition, demand from China to the US increased by 5% year on year in week 32 - the first increase compared with last year since mid-April.

In contrast, export tonnage from Asia Pacific to Europe has now declined for four weeks in a row, led by declines from China, South Korea and Indonesia.

“The opposing developments on sectors to Europe and North America suggest a potential rebalancing of Chinese airfreight exports and a re-engagement with the US as more tariffs are finalised,” WorldACD said.

While volumes between Asia Pacific and Europe have been trending downwards in recent weeks, they are up 7% year on year, driven by gains of 29% from Vietnam, 21% from Hong Kong and 8% from China.

On the spot rate front, pricing from Asia Pacific to the US rose 2% week on week but remains 14% down compared with a year ago.

”Rates from Taiwan to the US jumped 9% week on week but dropped 5% out of South Korea and 2% each from Japan, Vietnam and Singapore,” WorldACD said.

From China, rates to the US are down 11% compared with last year, but have improved 5% week on week.

”South Korea’s 5% drop in pricing followed a slump of 10% the previous week, which erased previous year-on-year gains,” the data provider added. ”Taiwan is the only market in the region to show higher rates (9%) to the US on a year-on-year basis. Declines range from 8% in prices out of Thailand to 29% out of Vietnam.”

Meanwhile, spot rates from Asia Pacific to Europe ”showed less turbulence”, being stable versus last week and down 3% year on year.

”Week on week declines out of China (-3%), Hong Kong and Singapore (-2% each), South Korea, Taiwan and Thailand (all -1%) were compensated by increases from Vietnam (+4%), Japan, Malaysia and Indonesia (all +3%).