Air cargo continued to beat expectations in August as volumes grew again, but the outlook for the remainder of the year remains uncertain.

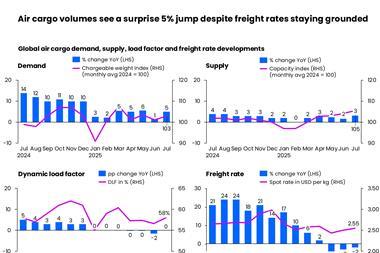

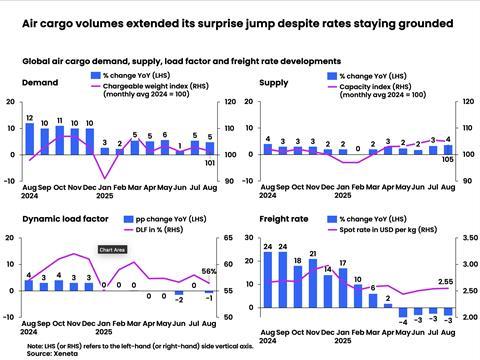

The latest figures from data provider Xeneta show that air cargo demand increased by a “surprise” 5% year on year in August - the second month in a row demand has grown at this level.

Xeneta said the increase in demand is likely to reflect modal shift as businesses look to move goods quickly by air rather than sea to avoid the potential impact of tariffs.

Capacity, meanwhile, increased by 4%year on year in August and the dynamic load factor was down slightly at 56%. It wasn’t all good news for air cargo - the average spot rate for the month declined by 3% year on year to $2.55 per kg.

Xenata said that airfreight spot rate performance was probably a better indicator of the underlying economic conditions than airfreight volumes.

“Air cargo’s higher demand remains the result of modal shift we saw in July, with a bit of support from e-commerce. It is not an indicator of increased economic activity. It’s just that airfreight is getting a bigger share,” said Xeneta’s chief airfreight officer, Niall van de Wouw.

“Many shippers looking to lessen the impact of tariffs just do not know how the market will look in 3-4 weeks’ time because of the lack of clarity.

”Consequently, I think more businesses are deciding to take a hit and move their products by air - but this good news for the air cargo market remains under constant review. Overall, it’s hard to see where strong, sustainable airfreight growth will come from.”

He added: "Because of all the uncertainty, the hurt for airfreight has been softened and delayed. But, for how much longer is anyone’s guess."

The decline in spot prices may be even steeper once currency effects are included, Xeneta said, with the dollar having lost 4% against other currencies over the past year.

On the other hand, a 7% fall in jet fuel prices may have helped protect carriers’ bottom line to some extent.

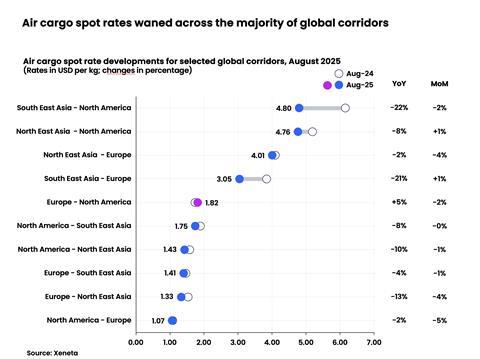

Xeneta figures show that air cargo spot rates from Southeast Asia to North America and Europe were down 20% year on year to $4.80 per kg and $3.05 per kg, respectively, as capacity constraints eased.

”North East Asia to North America routes fared somewhat better, with rates down 8% year on year and remaining stable compared with July. Delicate capacity management narrowed the pricing gap with Southeast Asia to less than five cents, settling at $4.76 per kg," Xeneta said.

North East Asia to Europe spot rates were steady compared with last year at $4.01 per kg and were down 4% on July levels.

"But this is at the cost of backhaul prices, which showed a 13% year-on-year decline due to continued trade imbalance," Xeneta said.

Spot rates on the transatlantic increased 5% year on year to $1.82 per kg, although volume and rate performance on the trade weakened as the month progressed.

"Seasonal holiday slowdowns in Europe and the fading effect of frontloading - previously spurred by extended Trump tariff deadlines - played their part in the lower demand," Xeneta said.

Looking ahead, the US decision to end the de minimis exemption for low-value e-commerce goods at the end of August is likely to impact markets from Canada, the UK and Mexico while Purchasing Managers’ indices in the big exporting economies fell in August, and American consumer sentiment also softened, Xeneta said.

“A lot of people think of de minimis as being about B2C, but the de minimis changes now in effect are also a big thing for B2B into the US and we are already seeing some SME businesses reacting to, and challenging, this impact,” van de Wouw said.

“The starting point for closing the de minimis threshold was mainly politically motivated against the big Chinese e-commerce platforms.

"But the widening of this legislation is levelling the playing field again for all e-commerce shipments entering the US, and I would now expect to see lower e-commerce volumes moving by air from Europe to the US. If anything, observers suggest this will now benefit China because of its lower production cost base.

“So, I see this having a bigger impact on B2B business and less on B2C. It adds another barrier of administrative procedures and cost to the supply chain,” he stated.