Image source: Shutterstock

Air cargo faces a tough end to the year as a result of shifting trade and tariff policies, but there are still plenty of opportunities for companies.

Speaking on a recent Freight Buyers’ Club podcast, Neel Jones Shah, senior advisor, The Boston Consulting Group and managing director at INOA Capital, said he is expecting peak season volumes to be down on last year due to the implementation of various US tariffs and the ending of the de minimis exemption.

However, his stance had softened from previous expectations of an airfreight recession.

“From a purely global macro perspective, this sort of tariff regime with retaliatory back and forth is not good for global trade and overall isn’t good for society,” said Jones Shah.

“And over the long term, I think that will play out negatively in terms of how quickly the world moves forward.

“That all being said, I don’t think we are going to see an airfreight recession because airfreight, in particular, thrives on chaos.”

“That all being said, I don’t think we are going to see an airfreight recession because airfreight, in particular, thrives on chaos.

“Chaos creates opportunity and we are in a chaotic time right now.”

Backing up Jones Shah’s thoughts, the air cargo industry enjoyed an unexpected 5% increase in volumes in July as companies looked to move goods ahead of the implementation of tariffs.

The industry has been able to capitalise on several waves of front-loading over the course of the year.

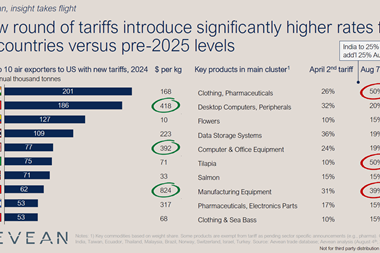

Jones Shah added that some trade lanes are likely to suffer more than others, in particular the China to US lane that currently faces tariffs of 30% (potentially rising further in November) and also in May saw the ending of the de minimis exemption for low-value e-commerce.

“But there are other [trades] that are going to far outperform anything we possibly thought as we head into 2026,” he added.

US Airforwarders Association executive director Brandon Fried agreed that the outlook for the rest of 2025 was tough, but also pointed out that airfreight thrives in challenging environments.

He added that its members had been recording strong growth figures over the summer, perhaps as shippers looked to get ahead of the tariffs that were added – or were planned – for August.

“It’s hard to pinpoint exactly what we’re going to see in the peak season, but generally speaking, the whole summer has been peak so far,” said Fried.

“I would agree with Neel, maybe a recession is not going to happen because these airlines and these carriers, they’re going to deploy to areas of opportunity.”

He added: “A lot of people are actually looking away from the US, they’re going into Latin American destinations, and that’s where they’re seeing the opportunities are now.

“They’re not necessarily abandoning the US, they’re just looking for areas where they can find profitability.”