Source: Shane Hoggatt/Shutterstock

Freighter operators are expected to see continued demand growth despite the US introduction of new tariffs on China, according to aviation consultancy firm Cirium.

In an analysis of the impact of the latest tariffs on the air cargo market, Cirium Ascend Consultancy valuations manager Herman Tse said that in the last trade war between China and the US in 2018/2019 freighter operators saw rising demand, despite a decline in the overall air cargo market.

Tse said that in 2018 air cargo demand growth slipped to 3.5% from more than 9% in 2017 and 2016. And in 2019 the industry reported a demand decline of 3.9%.

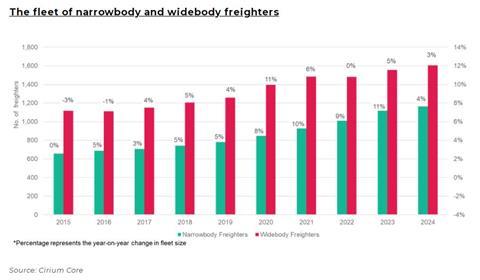

Despite this demand decline, Cirium data shows that the the number of widebody and narrowbody freighters in service increased by 4% and 5% respectively in 2019, while their average daily utilisation rose by 2% and 5% respectively.

Tse suggested that rising domestic demand as a result of the tariffs helped support the freighter market.

“This suggests that the tariffs imposed in 2018 did not significantly hinder freighter operations,” he said.

“In fact, the rising demand for domestic consumption in both China and the U.S. may have positively influenced narrowbody freighters.

“This trend is evidenced by global capacity (available cargo ton kilometres), which recorded consistent year-on-year monthly increases throughout 2019, culminating in a moderate 2.1% rise for the full year.”

However, it wasn’t all good news for freighter operators back in 2019. The market decline combined with rising capacity saw overall load factors decline by 2.6% which dragged down freighter operator profitability ”particularly in less efficient international operations”.

”The data indicates that the tariffs enacted in 2018 introduced some challenges, underscoring the complex dynamics of the global trade environment, but there were not insurmountable,” said Tse.

He said that one certainty of the tariffs introduced this time around is that air cargo demand may be expected to decline, but freighter operators should be protected.

“The extent of this decline will depend on the scope and coverage of the tariffs.

“Despite the potential short-term turbulence in specific markets, such as China and the US, demand for freighters seems unlikely to be significantly affected. Air cargo demand is projected to continue growing in the long term.

”However, small widebody freighter operators with a focus on the China-US market may face challenges if the tariffs are prolonged. These operators, with their smaller fleet sizes, might struggle financially under extended tariff implementations.”

In early February, US president Donald Trump announced 10% tariffs on all products from China, along with 25% tariffs for Mexico and Canada - although these have since been delayed for a month.

The US also announced that shipments from China would no longer benefit from the de minimis exemption, although this has also been temporarily delayed while US customs develops processes and systems to manage and collect duties on the millions of low value items that are handled each day.

Since then, Trump has also instigated a 25% import tax on all steel and aluminium entering the US. He also has the European Union in his sights for further tariffs.