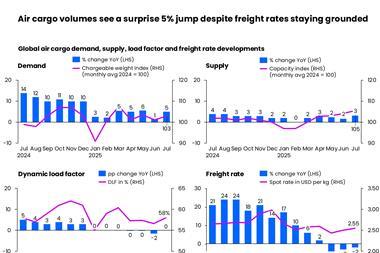

Air cargo rates appear to have temporarily settled down after a tumultuous period, with TAC Index only reporting a ”relatively modest” decline last week.

The latest statistics from TAC Index show that global airfreight rates declined 0.6% last week and are down around 5.3% compared with a year earlier.

In a market update, TAC said that the modest decline came despite the removal of capacity from the transpacific over recent weeks.

”[The decline] seems relatively modest given the significant switching of freighter capacity away from transpacific routes in recent months, only partly reversed following the 90-day tariff deal between the US and China, which has been making some players more bearish about the outlook globally,” TAC said.

The company added that rates from China to the US were actually higher than a week earlier.

Meanwhile, freight forwarder Dimerco said that there was no sign of a recovery in e-commerce volumes out of China following the US decision to remove the de minimis exemption for packages from the country.

A rapid increase in e-commerce demand has fuelled the addition of freighter capacity on the transpacific in recent years. These packages now need to pay a tariff rate of 30%.

"Scheduled freighter flights continue to be cancelled. In contrast, demand out of Southeast Asia — particularly from Thailand and Vietnam — is starting to pick up due to the upcoming tariff deadline in July,” the forwarder said.

Capacity statistics from data provider Rotate reflect the removal of capacity from the trade lane, but, like rates, this development also appears to have settled down.

Weekly widebody freighter capacity from Asia Pacific to North America has been between 66,000 to 67,000 tonnes for the past three weeks. Capacity on the trade peaked in mid-March at 75,000 tonnes before dropping to 51,000 tonnes in early May when US tariffs peaked at 125%.

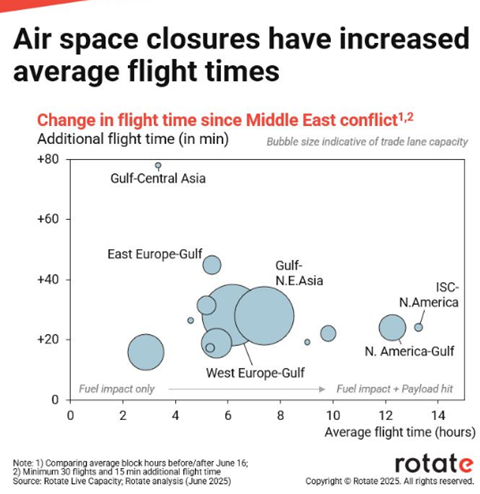

One development that could affect the market is disruption in the Middle East as conflict in the region escualtes, meaning airlines are having to divert flight from airspace above certain countries.

Rotate vice president and head of consulting Tim van Leeuwen said data shows flight times on several major lanes have increased by up to 30 minutes, with some even increasing by 80 minutes, as airlines take detours and there is in-air congestion/take off delays due to limited lanes being available.

”On (relatively) short flights (for example, between Western Europe and the Gulf), this extra flight time will mostly lead to extra fuel burn only,” said van Leeuwen in a LinkedIn update.

”However, on long-haul flights (for example, between North America and the Gulf) airlines may be forced to take a cargo payload hit also, in exchange for additional fuel.”

Airlines are beginning to restart flights over the region. Yesterday, Qatar Airways said it has resumed operations in Iraq and Syria and returned to full flight schedules in Lebanon and Jordan.

Dimerco added that intra-Asia traffic is “holding strong”.

“Intra-Asia traffic is holding strong, especially on routes linking China with Taiwan, Vietnam, Thailand, Malaysia, and Singapore. Capacity on these lanes is tight, and we’re seeing higher rates compared to the same period last year,” Dimerco.